Share2: A Bill Splitting App Case Study

A Strategic MVP to Reduce Social Friction in Shared Finance

*What you're about to see is a case study I've compiled for a design challenge and a product design project. Please note that it's not a fully functional product yet.Overview

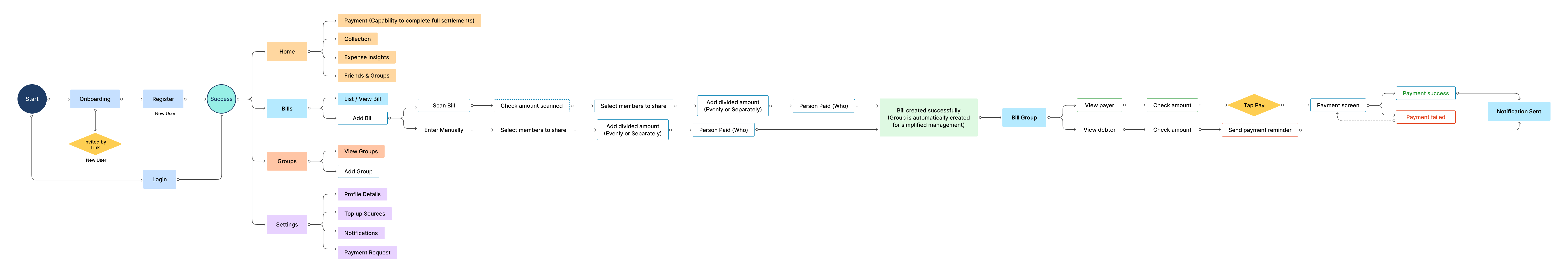

In this case study, the design journey of Share2 (Pronounce share-share) will be explored, commencing with the initial concept and progressing through the user journey. Additionally, the key facets of its design will be examined, with an emphasis on the principles behind its core features as necessary.

The Problem: Shift from "Math" to "Psychology"

The Challenge: The "Awkward Tax"

- While there are many bill-splitting apps, most treat the experience as a transactional calculator. My research suggested that the primary pain point isn't the math, it's the social anxiety of asking friends for money.

The Opportunity

- I identified a gap for a "Relationship-First" financial tool. By shifting the mental model from "Charging a Friend" to "Updating the Group Ledger," we can remove the emotional friction and increase user stickiness.

The Goals

This case study tackles bill-splitting challenges by designing an accessible tool. The aim is to simplify expense sharing, promote fairness, and enhance transparency, benefiting users in managing shared expenses. These also could include:

- Simplicity: Prioritize a straightforward and intuitive user interface for seamless bill splitting.

- Equity: Ensure fairness in cost-sharing among all users.

- Transparency: Offer clear visibility into financial contributions and shared expenses.

- Efficiency: Streamline debt settlement procedures to resolve financial imbalances effectively.

Implementing these goals in the bill splitting app aims to simplify complex expense sharing, ensure fair cost distribution, boost financial transparency, and streamline debt settlement. Addressing these issues will enhance users' financial experiences and social interactions.

The Approach

Strategic Scope & MVP Definition: For this concept to be a viable product, I had to make strict scoping decisions to define the MVP (Minimum Viable Product).

Prioritizing "Groups" over "Quick Splits"

- Why: "Quick Splits" (one-off dinners) have high churn. "Groups" (housemates, trips) create high retention and lock-in. I architected the app around persistent Groups to drive higher Lifetime Value (LTV).

Manual Entry vs. OCR (Receipt Scanning)

- Why: While OCR is a "delighter" feature, it is technically expensive and error-prone for a V1. I strategically de-scoped OCR to focus on a rock-solid manual entry flow. The goal was trust and speed, not technical novelty.

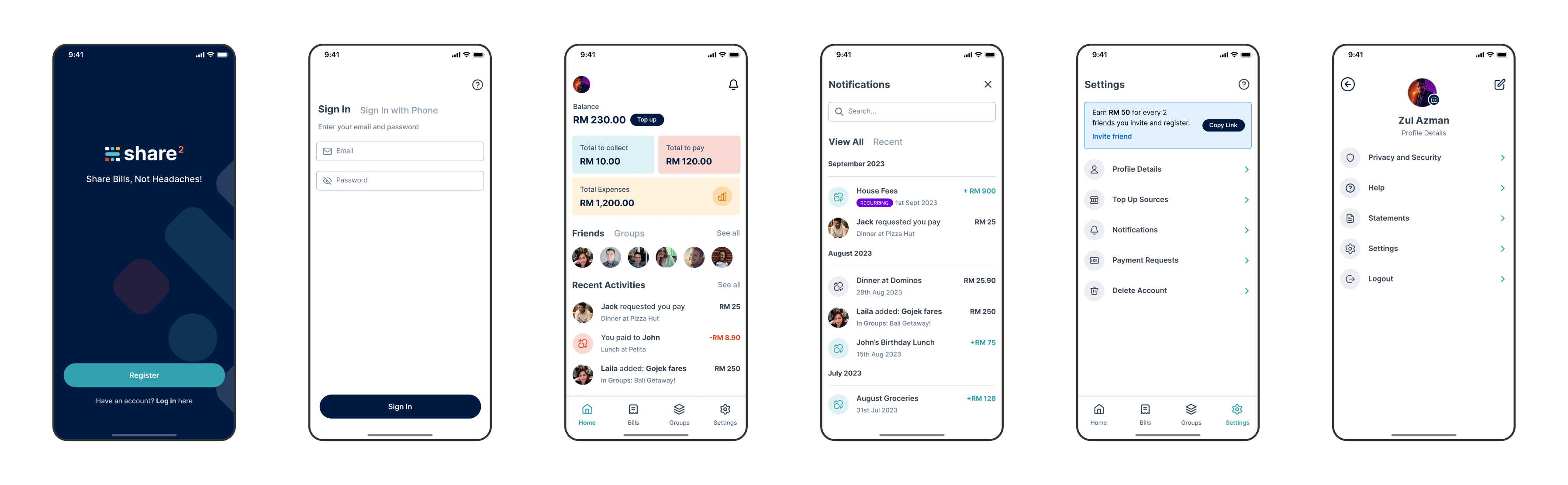

Seamless Journey: From Registration to Bill Settlement

This journey reveals the implementation of its design objectives, ensuring a seamless user experience from registration to bill settlement, and explores Share2's core design elements and innovative features.

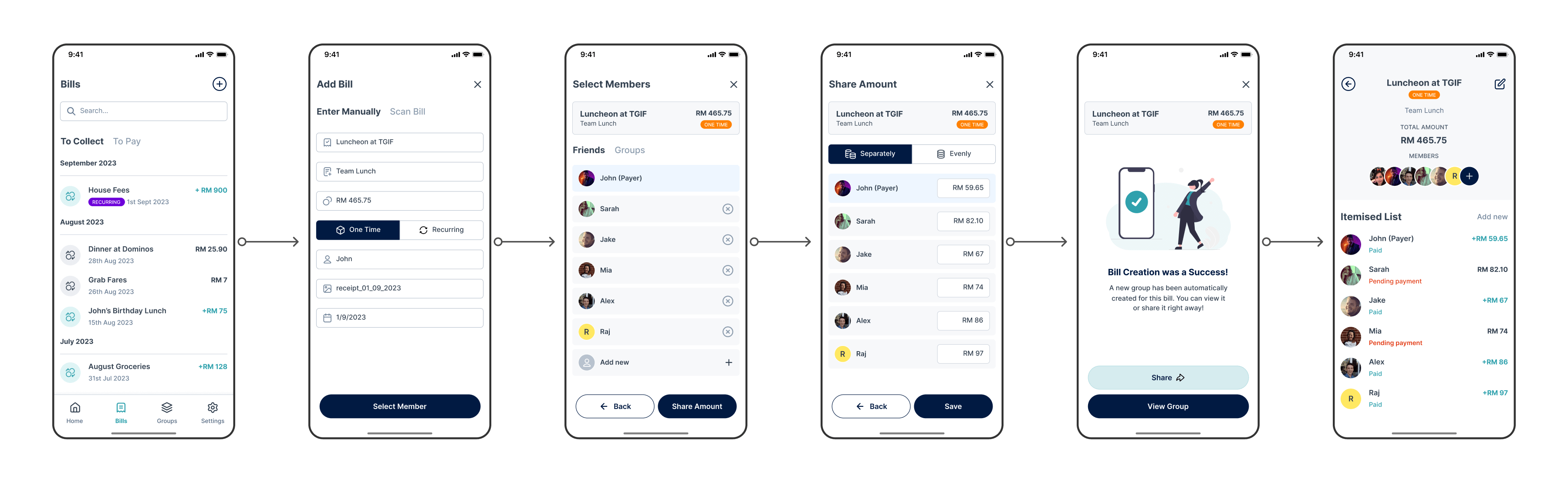

Creating Bills: Simplify and Split with Ease

Share2 simplifies expense management with efficient bill creation. Discover how Share2 enhances bill generation for a user-friendly experience, complete with innovative features.

Transparency as a Feature

- In financial apps, clarity equals trust. I designed the "Split" interaction to be fully transparent, showing exactly who owes what in real-time.

- The Goal is to reduce "Dispute Rates" (a key hypothetical metric for this product).

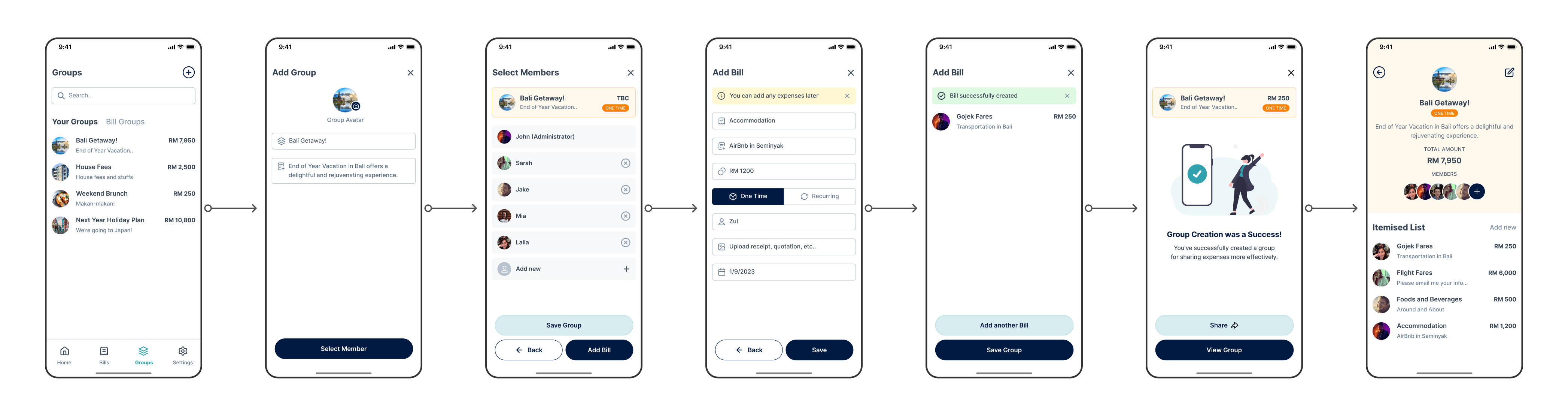

Streamlining Bill Splitting through Group Creation

Share2 empowers users with the flexibility to set up groups for diverse objectives. Whether it's planning a group vacation with friends or efficiently managing expenses related to apartment living, including rent and bills, Share2 provides the functionality to streamline these collaborative activities.

The "Group" Object

- By making the "Group" the central entity (rather than the "Bill"), I reduced the cognitive load for recurring users.

Exploring Additional Screens

These additional screens introduce valuable features that enhance the overall user experience, ensuring smoother financial management and expense sharing.

Looking Forward: Success Metrics & Roadmap

As a conceptual proposal, the next step would be to validate these design hypotheses with live users. If I were leading this product team, these are the KPIs I would track:

- Group Retention Rate: Are users coming back to the same Group next month? (Measuring Value)

- Time-to-Settlement: How fast does a debt get marked as "paid" after being posted? (Measuring Efficiency)